- GET A FREE CONSULTATION

REPAIR YOUR CREDIT Rebuild Your Future Achieve Your Dreams

We provide expert credit repair services to help you achieve your financial goals. Our comprehensive approach addresses inaccuracies, challenges negative items, and guides you toward a stronger financial standing. Let us help you navigate the complexities of credit repair and unlock opportunities for homeownership, education, and more.

Good Credit Makes better life

We work with you to help you Repair Your past. Monitor Your present, and build your future

Buy Or Refinance Your Home, Rent an apartment

Accomplish Your Financial Goals and your future

Purchase A new vehicle, Open a new business

Get Approved for Credit Card or a loan

Why Us

At Credit Fix Total, we understand that navigating the complexities of credit repair can be overwhelming. That’s why we’re committed to providing personalized, effective solutions tailored to your unique situation. With our team of experienced professionals, cutting-edge technology, and unwavering dedication to client success, we’re confident that we can help you achieve your credit goals.

Aggressive Dispute Resolution

We specialize in resolving credit disputes to help improve your credit score. Our expert team will work with you to identify inaccuracies and challenge them with credit bureaus.

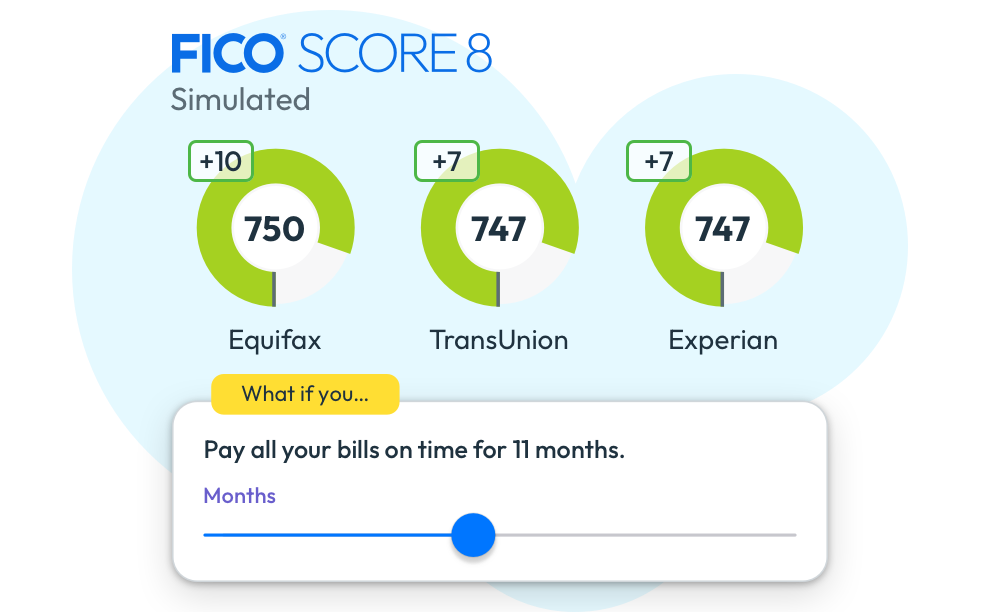

Comprehensive Credit Analysis

We analyze your credit reports from all three major bureaus - Equifax, Experian, and TransUnion - to identify inaccuracies, errors, and negative items impacting your score. This detailed assessment forms the foundation of your personalized credit repair plan.

Strategic Debt Negotiation

Our skilled negotiators work directly with your creditors to lower outstanding debt balances and establish affordable, manageable payment plans. This proactive approach not only reduces your financial burden but also demonstrates responsible financial behavior, positively influencing your creditworthiness.

Expertise and Experience

Our team comprises seasoned credit repair specialists with extensive knowledge of credit laws and regulations. With years of experience in the industry, we have successfully assisted numerous clients in achieving their credit goals.

Transparent Process

We believe in transparency and open communication throughout the credit repair process. From the initial consultation to ongoing updates, we keep you informed every step of the way.

Proven Results & Personalized Solutions

We have a track record of success in helping our clients improve their credit scores and achieve their financial dreams, We don't believe in one-size-fits-all solutions. We take the time to understand your unique credit situation and develop a customized plan tailored to your specific needs and goals

Our Services & Expectations

We set high expectations for ourselves as a credit repair company. You can expect only the best service from our team of credit experts. In the economic industry, we are dedicated to helping our clients get back on financial track.

Repair Your Credit

Rebuild Your Credit

Raise Your Score

maintain your good credit

How it Works

- Identifying the Problems

Part of the first step on the path to better credit is to identify the inaccurate information that is bringing your score down. This is done through a deep credit analysis process. Once we know what the problems are, we will give you the information you need to take action to start having those inaccurate remarks remove and ultimately build your credit score.

- Analyzing the Updated Reports

After the updated reports have come back in from the suppliers, we will go over them once again to verify the inaccurate, unverifiable or misleading was removed or updated. If the information is still on the report, we go back to the entities that furnished the report and start asking questions about why the information was not removed or updated. If the information on the report has been updated, we move on to the next item that is worthy of a dispute.

- Challenging the Bureaus & Creditors

Once we have identified all of the information that is not verifiable, inaccurate or misleading, we input it into our system. This allows us to begin the challenging process. The process will challenge the information reported by the credit bureau, the creditor and the collector. The dispute letters are sent out to each party. This process can take 30 to 40 days as we wait for replies and updates. You will be able to check the status of your credit repair via our online portal. We work to restore your credit from start to finish.

- Weekly Education & Monthly Updates

During the credit restoration process, we will provide you with information and the education you need to continue raising your credit score. You will be given information about debt settlement and what it takes to rebuild your credit. This education process will happen via emails. Things like legal assistance, credit monitoring and rebuilding your credit cards will all assist you on the path to restoring a healthy credit score and maintaining it.

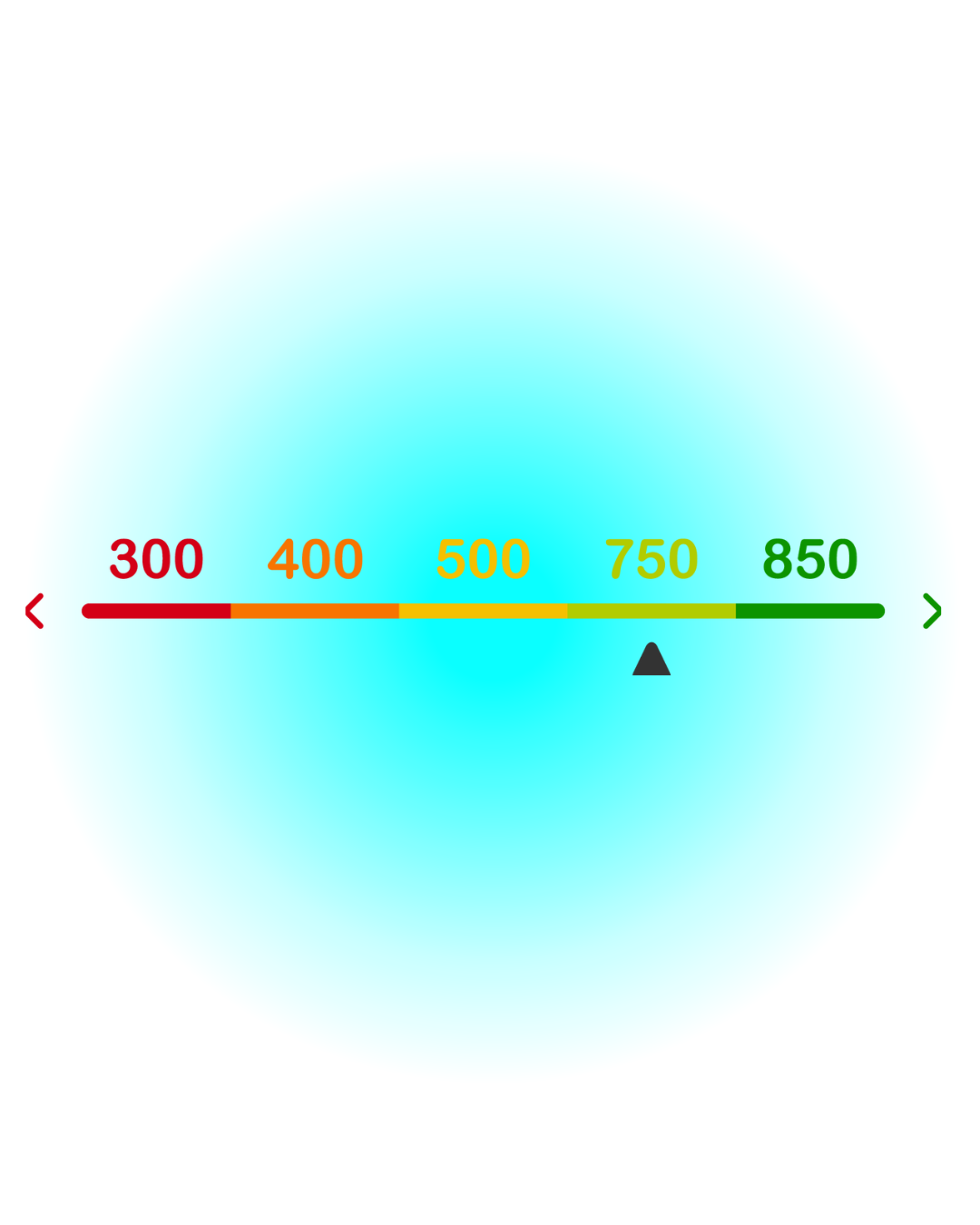

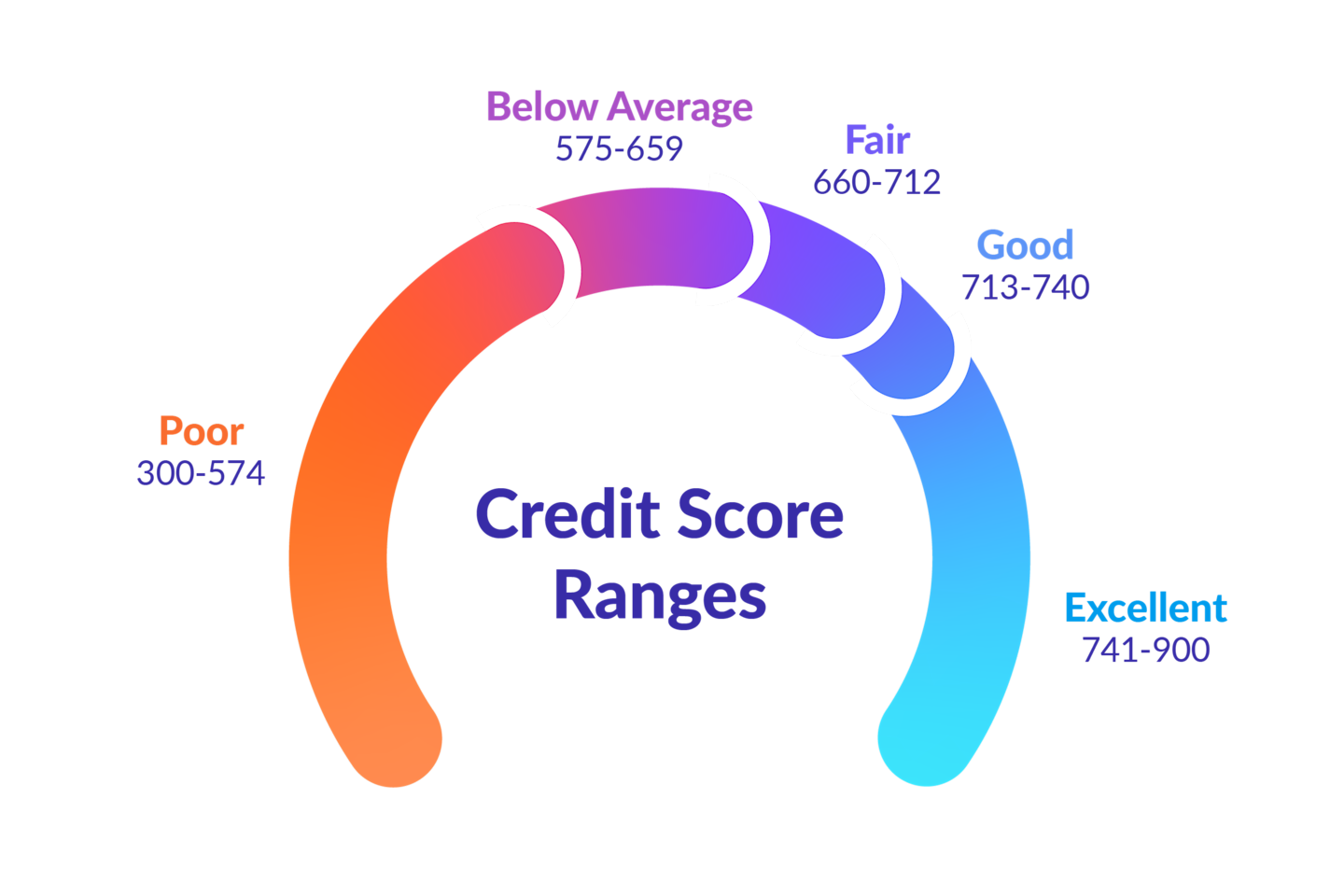

What is Bad Credit and How Do I Fix It

Bad credit can stem from various issues, including late payments, high credit utilization, defaults, or bankruptcies. Understanding the root cause is the first step to fixing it.

350 to 650

Any score lower than 650* is generally considered “bad”

Bad credit could keep you from

Approvals

Getting approved for a mortgage

Low Rates

Securing good rates on a car loan

Top credit cards

Getting a low-interest credit card

Loans

Borrowing money from a prime lender

Self Service Signup

Our Services

Explore our services to learn more about how we can assist you

Credit Repair Services

The first step in getting your financial life back is removing inaccurate information from your credit report. The law allows any consumer to challenge inaccurate information on their credit report if that consumer feels that the items are inaccurate.

Rebuild Your Credit

The second step to restoring your credit is to rebuild it while we work on removing inaccurate information. It’s not enough just to remove negative items, but you must prove to the FICO and creditors that you can make your payments on time.

Raise Your Score

The third step to restoring your credit is to focus on raising your credit score. As we all know, the credit score is the number one factor when it comes to getting approved for a loan. If you have a low credit score, you can get denied or pay high interest rates.

Business Credit Builder

We’ve helped small businesses all over the US take their business from idea to reality,Understand where your business stands today, what your options are, and how to move forward.

What Can be Remove From your Credit.

We specialize in repairing various inaccuracies and negative items on your credit report, including:

Bankruptcies

Bankruptcy filings can have a long-term negative impact on your credit report. We can help you explore options for mitigating the impact of bankruptcy on your credit score.

Inquiries

Too many inquiries on your credit report can lower your credit score. We help you address unauthorized or unnecessary inquiries to improve your creditworthiness.

Judgments

Judgments resulting from lawsuits can negatively impact your credit. We help you address judgments and explore options for removal or resolution.

Tax Liens

Tax liens can significantly lower your credit score and make it difficult to obtain credit. We can help you dispute tax liens to potentially have them removed from your credit report.

Late Payments

Can significantly lower your credit score. We can help you dispute late payments that are inaccurate or have been reported incorrectly.

Collections Accounts

Collection accounts can have a major negative impact on your credit score. We can help you dispute collection accounts to potentially have them removed from your credit report.

Charge-Offs

A charge-off occurs when a creditor writes off a debt as uncollectible. We can help you dispute charge-offs to potentially have them removed from your credit report.

Personal Information

Incorrect personal information on your credit report can lead to errors and inaccuracies. We help ensure that your personal information is accurate and up-to-date.

Repossessions

Repossessions occur when a lender seizes property due to missed payments. We can help you dispute repossessions to potentially have them removed from your credit report.

Foreclosures

Foreclosures can have a devastating impact on your credit score and make it difficult to obtain future financing. We can help you explore options for mitigating the impact of foreclosure on your credit score.

Student Loan Defaults

Student Loans: We can help you explore options for managing student loan debt, including disputing errors and seeking loan forgiveness or rehabilitation programs.

Medical Bills

Medical bills, even if paid, can sometimes negatively impact your credit score if they appear on your credit report. We assist in disputing and removing medical bill entries to improve your creditworthiness.

What Our customers say about us

See what our clients are saying about their experience with Credit Fix Total.

What Business Owner are saying about their experience with Us

Personal Credit Testimonial

Our Customer support

Get Started Today,

Get Ready for a loan, for your business

Sign up today to unlock our most value-packed Services

The timeline for credit repair varies depending on the complexity of your credit situation. However, most clients see results within 3-6 months.

We can help remove inaccurate or outdated negative items such as late payments, collections, charge-offs, inquiries, bankruptcies, and more…

A credit score is a three-digit number that reflects your creditworthiness. Lenders use it to assess the risk of lending you money. A good credit score can help you get approved for loans, credit cards, and other financial products with favorable terms.

You can obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year by visiting AnnualCreditReport.com.

Credit repair involves identifying and disputing inaccurate, outdated, or unverifiable information on your credit reports. The goal is to remove negative items and improve your credit score.

While we cannot guarantee a specific credit score improvement, we are committed to providing you with the best possible service to help you achieve your financial goals. The extent of credit score improvement can vary depending on individual circumstances.

Our pricing varies depending on the services you need. We offer a free consultation to assess your situation and provide you with a customized quote.

Most negative items, such as late payments and collections accounts, can stay on your credit report for up to seven years. Bankruptcies can stay on your report for up to ten years.

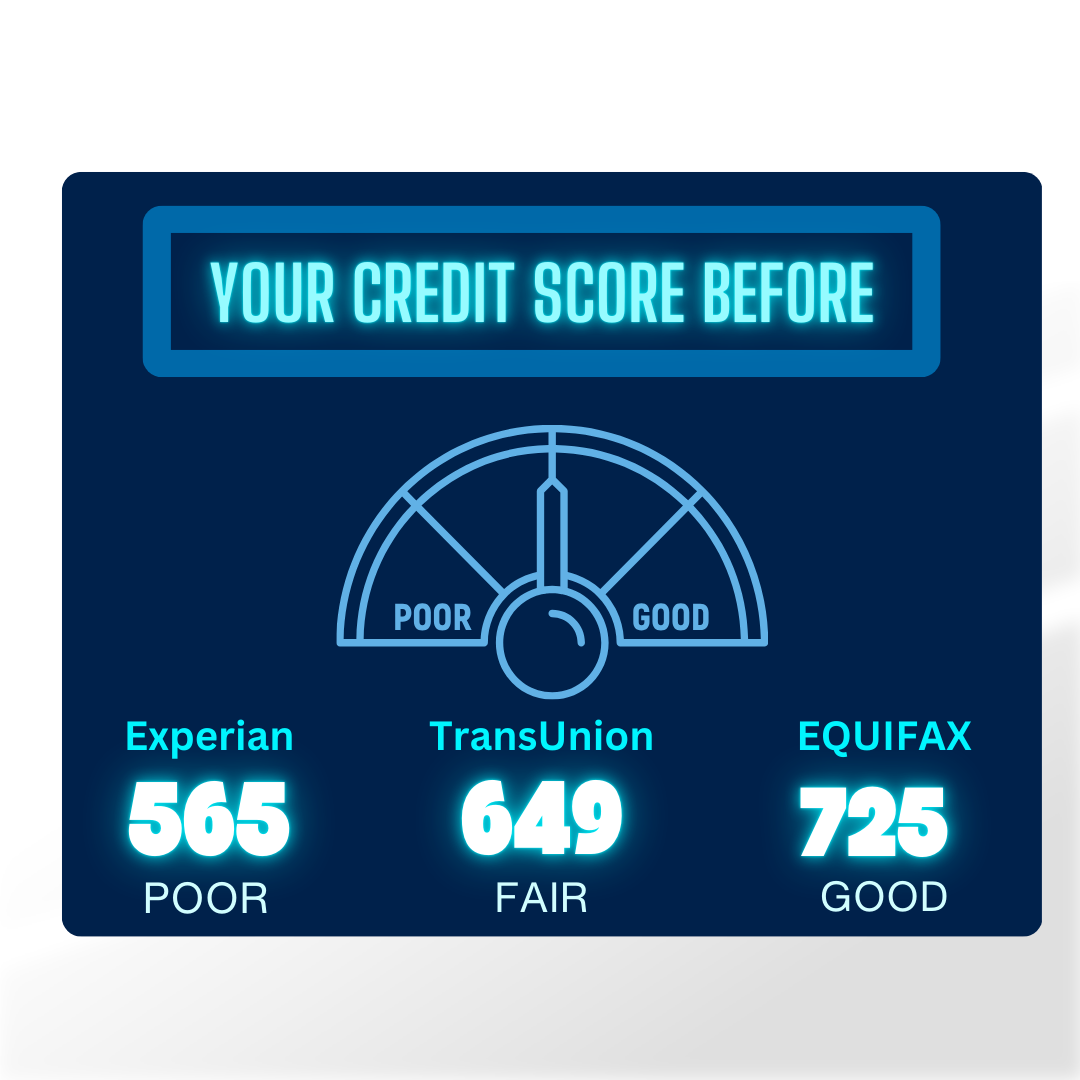

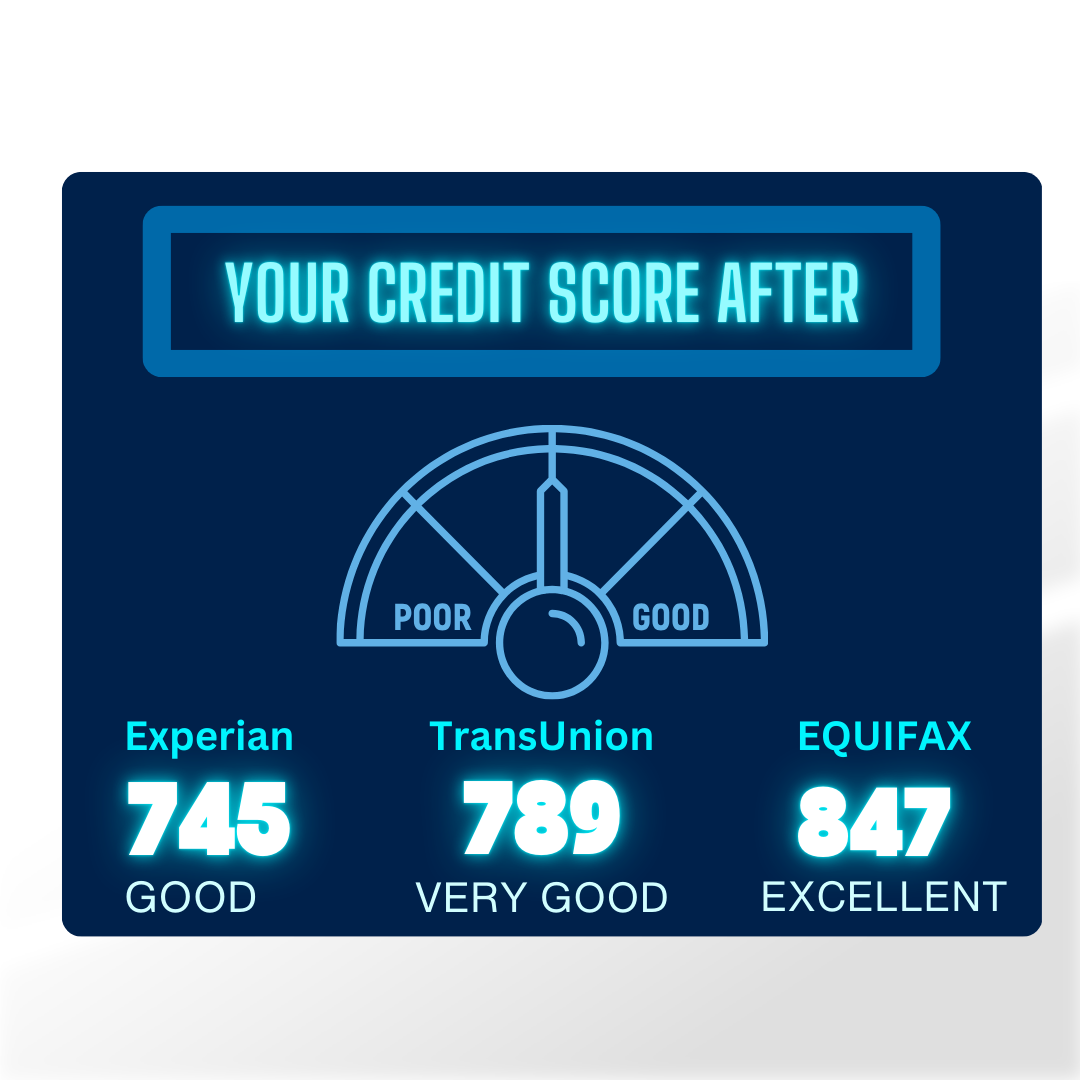

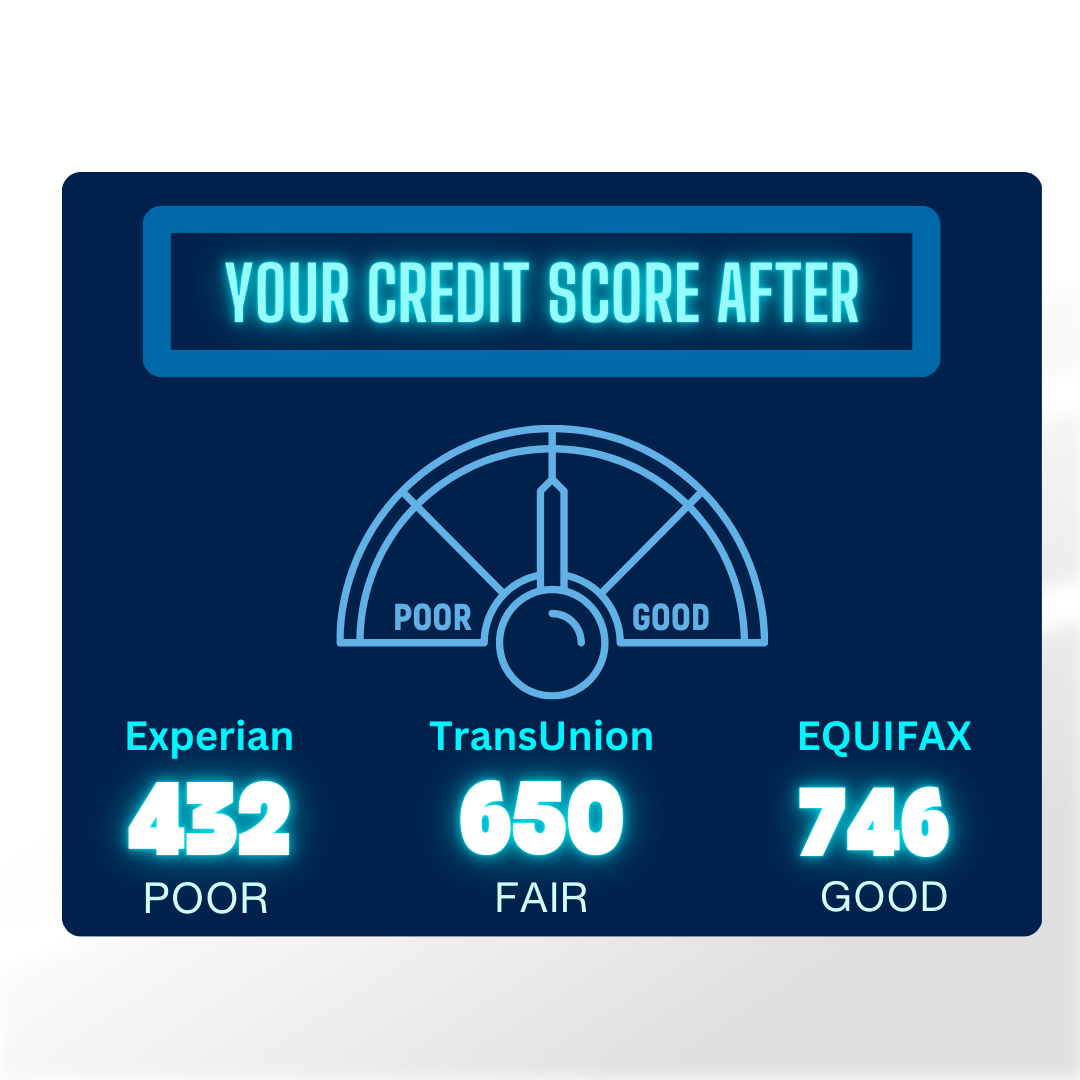

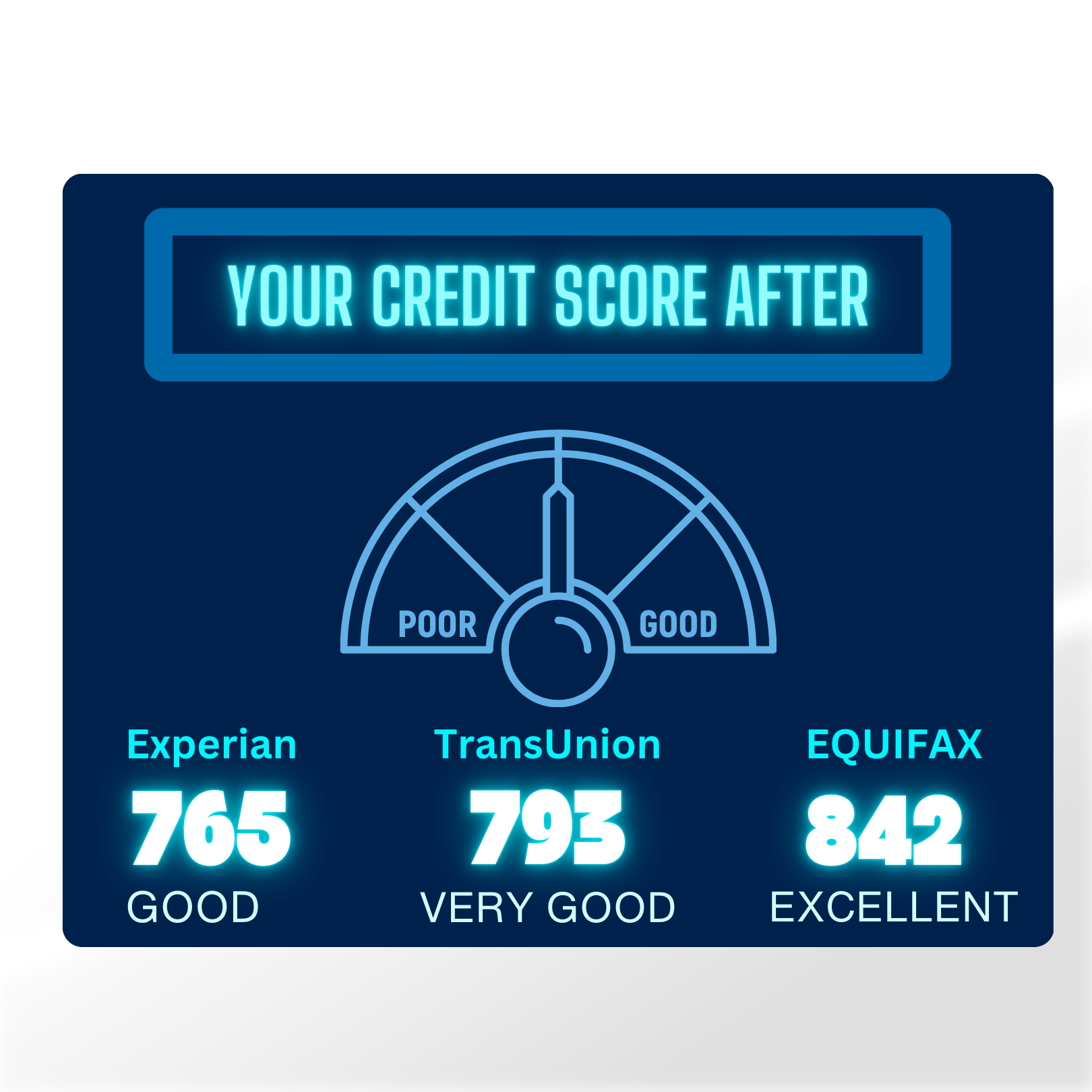

Before & After

Unlock Your Business Potential with Strong Credit

We specialize in building or repairing credit for your business.

Building strong business credit is essential for long-term success. We provide guidance and strategies to help you establish and improve your business credit profile.

With solid business credit, you’ll gain access to better financing options, favorable terms with vendors, and increased opportunities for growth. We’ll work with you to navigate the complexities of business credit reporting and build a strong foundation for your business’s financial future.

How we do it

See what Business Owner are saying about their experience with Credit Fix Total.

Company

- About Us

- Features

- Our Pricing

- Contact Us

Resources

- App Store

- ATM Finder

- Card Limits

- Privacy Policy

Useful Links

- Free Quote

- Career Center

- Help & Support

- Terms Conditions

Creditfixtotal with Passion by 1800siteweb(design by Luis Payano © 2025 All rights reserved